Happy Holidays from Alisa Na CPAs and Advisors!

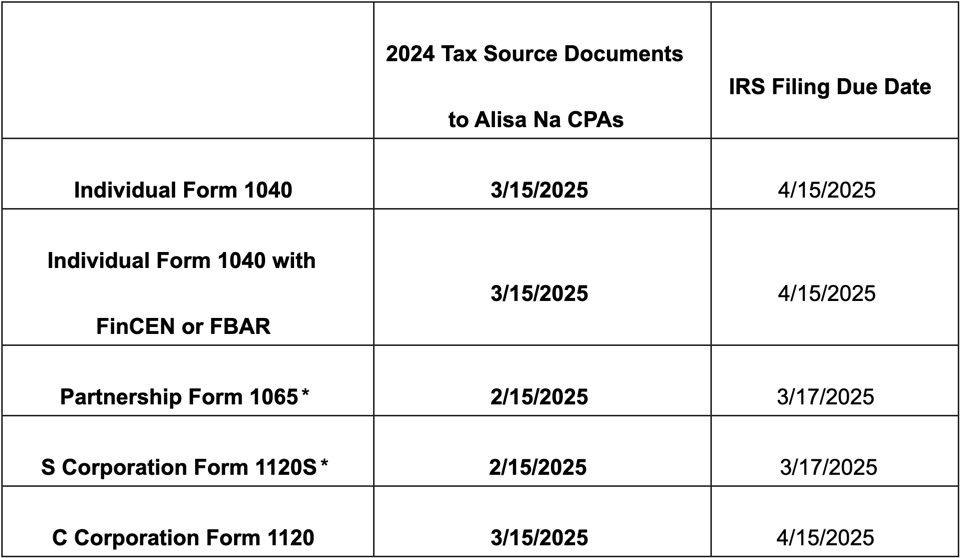

With 2025 approaching, we want to share essential tips for our individual and business clients.

The Internal Revenue Service encouraged taxpayers to take key steps now to prepare for filing their 2024 federal income tax returns next year. There are several things’ taxpayers can do to get ready as the end of 2024 nears and the start of the 2025 tax season approaches.

Gather and organize 2024 tax documents

To make tax time easier, taxpayers should establish an adequate record-keeping system, either electronic or paper, to organize all essential documents in one place. This includes year-end income forms such as Forms W-2 from employers, Forms 1099 from banks or other payers, Forms 1099-K from third-party payment networks, Forms 1099-NEC for nonemployee compensation, Forms 1099-MISC for miscellaneous income, Forms 1099-INT for interest income and records of all digital asset transactions.

Having all necessary documentation ensures taxpayers can file an accurate return and reduces the likelihood of processing delays or refund issues.

Please download our 2024 Tax Prep Checklist to help you gather and organize your 2024 Individual Tax documents. We also have a Tax Organizer for Small Business (Sch. C) and Rental Property (Sch. E).

IRS Online Account

Individuals can create or access their IRS Online Account at Online account for individuals. Currently, the IRS Online Account is not available for Business accounts. With an IRS Online Account, you can:

- View, make, and cancel payments.

- Set up or change payment plans and check their balance.

- View key details from their most recent tax return, such as adjusted gross income.

- Request an Identity Protection PIN.

- Get account transcripts to include wage and income records.

- Sign tax forms like powers of attorney or tax information authorizations.

Get an Identity Protection Personal Identification Number (IP PIN)

An IP PIN is a six-digit number that prevents someone else from filing a federal tax return using an individual’s Social Security number or Individual Taxpayer Identification Number. It’s a vital tool for ensuring the safety of taxpayers’ personal and financial information.

The best way to sign up for an IP PIN is through the IRS Online Account. If an individual cannot create an Online Account, alternative methods, such as in-person authentication at a Taxpayer Assistance Center, are available.

Deadline for 2024 last quarterly estimated payment is Jan. 15, 2025

Taxpayers with non-wage income—such as unemployment benefits, self-employment income, annuity payments, or earnings from digital assets—may need to make estimated or additional tax payments. The Tax Withholding Estimator on IRS.gov can help wage earners determine if they need to make an additional payment to avoid an unexpected tax bill when filing their return.

Prepare to include digital assets on taxes in 2025

Like previous filing years, taxpayers must report all digital asset-related income when they file their 2024 federal income tax return.

When filing 2024 federal income tax returns, taxpayers will be asked to answer “Yes” or “No” to the following question:

“At any time during the tax year, did you:(a) receive (as a reward, award or payment for property or services); or (b) sell, exchange or otherwise dispose of a digital asset (or a financial interest in a digital asset)?”

Taxpayers who answer “Yes” must report all income related to their digital asset transactions.

Be sure to keep records that prove their purchase, receipt, sale, exchange, or any other disposition of the digital assets, and that includes the fair market value, as measured in U.S. dollars, of all digital assets received as income or as a payment in the ordinary course of a trade or business. Information on how to report digital asset transactions, including calculating capital gain or loss, determining basis, and reporting the income on the correct form, can also be found on the digital assets landing page.

Understand refund timing and how to avoid delays

Several factors can influence the timing of a refund after the IRS receives a tax return. While the IRS issues most refunds in less than 21 days, taxpayers are advised not to depend on receiving a 2024 federal tax refund by a specific date. Some returns may require additional review and take longer to process if there are possible errors, missing information, or indications of identity theft or fraud.

Additionally, under the PATH Act, the IRS cannot issue refunds for tax returns claiming the Earned Income Tax Credit (EITC) or the Additional Child Tax Credit (ACTC) before mid-February.

Use direct deposit for a faster refund

Filing electronically and selecting direct deposit remains the fastest and safest way for taxpayers to receive their 2024 tax refunds. Direct deposit ensures quicker access to refunds compared to receiving a paper check. Please provide the most updated bank account information to your tax preparer for a faster refund.

Key Tax Updates

- Washington’s Long Term Capital Gain Tax – Washington’s Long Term Capital Gain Tax of 7% is due on April 15, 2025, for long-term gains greater than $270,000 (except for real estate and several other circumstances). There are penalties for not paying in April. Please get in touch with us in February if you would like to schedule a consultation regarding this. For more detail, please click here to visit the Department of Revenue’s page.

- The child tax credit – The child tax credit is $2,000 for dependent children under 17 (The refundable portion of the child tax credit is $1,700). You qualify for the full 2024 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than $200,000 for a single return ($400,000 if filing a joint return).

- IRS gift exclusion – The IRS gift exclusion is $18,000 in 2024 and $19,000 in 2025, respectively. Gifts above these amounts should be reported on the gift tax return.

- Federal lifetime gift and estate tax – As of January 1, 2024, the federal lifetime gift, estate, and GST tax exemption amount increased to $13,610,000 per person.

- Educator Credit – You can deduct up to $300 of unreimbursed classroom expenses if you are an eligible educator. If both spouses are educators and file jointly, they can deduct up to $600 (with each individual capped at $300).

- Interest Rate – Due to inflation, the underpayment or late interest rate for individual taxpayers will increase to 8% in 2024. Please consider making estimated payments by April 15th, even if you request an extension to file your tax return.

- Social Security benefit and wage base – Social Security benefits will increase by 2.5% beginning in 2025. Social Security wage base will increase to $176,100 in 2025.

- IRS Business Mileage rate – The IRS standard mileage rates are 67 cents per mile for business purposes in 2024 and 70 cents per mile beginning Jan. 1, 2025. Standard mileage rates | Internal Revenue Service

- Form 1099-K – Taxpayers who received over $5,000 ($2,500 in 2025 and $600 in calendar year 2026 and thereafter) in payments for goods and services through an online marketplace or payment app in 2024 should expect to receive a Form 1099-K in January 2025. However, they can send you a Form 1099-K with lower amounts. Although the IRS is taking a phased approach to implementing the Form 1099-K reporting threshold, companies could still send the form for over $600. Whether or not you receive a Form 1099-K, you must still report any income on your tax return.

- Student Loan Forgiveness – Student Loan Forgiveness will not be taxable on Federal returns but may be taxable in some states.

- Charitable contributions – We recommend obtaining receipts for all charitable contributions. For more details, please check IRS website: Charitable contribution deductions | Internal Revenue Service

- EV credit – In 2025, you can get a tax credit for electric vehicles (EVs) tax credit of up to $7,500 for a new EV or $4,000 for a used EV. New EV credit is divided into two parts: $3,750 for meeting battery part requirements and $3,750 for meeting critical minerals requirements. Vehicles that satisfy both conditions are eligible for the full $7,500 credit. The income limits for the EV credit are $300,000 for married filing jointly and $150,000 for Single filers.

- Home energy credit – If you make qualified energy-efficient improvements to your home after Jan. 1, 2023, you may qualify for a tax credit of up to $3,200. You can claim credit for improvements made through 2032. The maximum credit you can claim each year is:

- $1,200 for energy-efficient property costs and specific energy efficient home improvements, with limits on exterior doors ($250 per door and $500 total), exterior windows and skylights ($600), and home energy audits ($150).

- $2,000 per year for qualified heat pumps, water heaters, biomass stoves, or biomass boilers.

- The Maximum Retirement contributions for 2024

- $7,000 for Traditional IRA or Roth IRAs ($8,000 if you are age 50 or older)

- $16,000 for SIMPLE IRAs ($19,500 if you are age 50 or older)

- $23,000 for 401ks ($30,500 if you are age 50 or older)

- $69,000 for SEP IRAs (Contributions cannot exceed the lesser of 25% of the employee’s compensation or $69,000 for 2024)

- The Maximum Health Savings Account (HSA) contributions for 2024

- $4,150 for Self-only coverage

- $8,300 for Family coverage

- Those 55 and older can contribute an additional $1,000 as a catch-up contribution.

If you have questions, be sure to reach out to us.