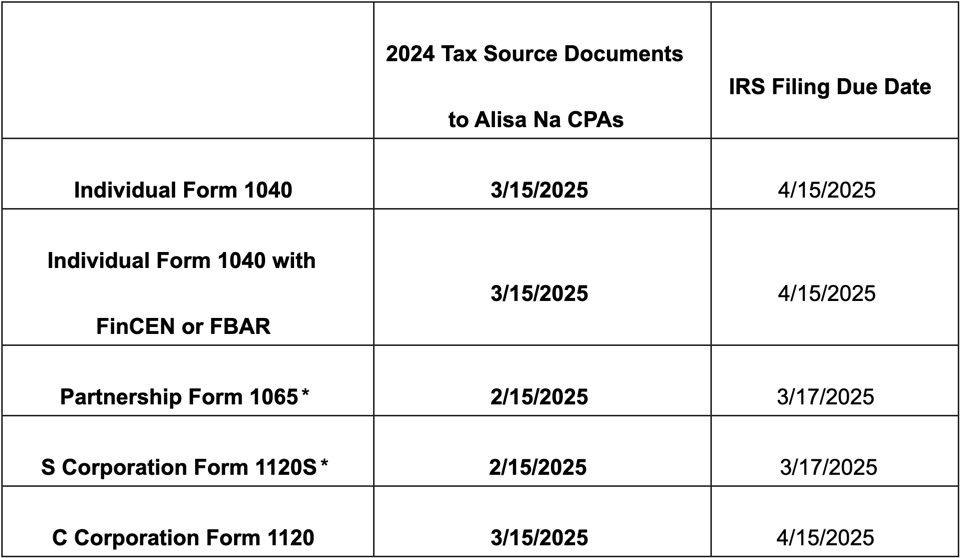

| *If you have not yet submitted tax source documents for Partnership and S Corporation tax returns by February 15th, please contact us to request an extension.

If you are unable to upload your documents by the deadlines mentioned above, please contact our office to request an extension. However, please note that if you have a tax liability, late payment penalties and interest may begin to accrue from the original due date, even if an extension is filed.

To assist with your tax preparation, we have prepared a personalized client organizer for you. This includes a set of questions to help us identify any changes that may impact on your tax return, as well as a record of documents you have previously submitted.

If you would like to receive this organizer, please contact us via email or phone, and we will be happy to provide it.

Once all your tax source documents are ready, please upload them to our secure portal and notify us by email or phone to confirm receipt. Please note that we can only begin preparing your tax return after all required documents have been received.

For the 2024 Tax Prep Checklist, Tax Preparation Workflow Information, and a secure upload link, please go to Income Tax Preparation Process page. |