| 2025 Minimum Wage Resources

Washington State: https://www.lni.wa.gov/news-events/article/24-24

The Washington State Department of Labor & Industries (L&I) announced an increase in the state’s minimum wage to $16.66 per hour, effective on January 1, 2025.

Seattle: https://www.seattle.gov/laborstandards/ordinances/minimum-wage?utm_medium=email&utm_source=govdelivery

Starting January 1, 2025, all employers, regardless of schedule size, will be required to pay the same minimum wage of $20.76 per hour. Small employers will no longer be able to count tips and/or payments toward an employee’s medical benefit plan toward an employee’s minimum compensation requirements under Seattle’s Minimum Wage Ordinance.

Bellingham: https://cob.org/services/business/city-minimum-wage

On January 1, 2025, the city minimum wage will be set at $1.00 above the applicable Washington State minimum wage ($17.66).

Starting May 1, 2025, the city minimum wage will be set at $2.00 above the applicable Washington State minimum wage.

Every year after, starting in 2026, the city minimum wage will be set at $2.00 above the applicable Washington State minimum wage, effective on January 1 every year. The city will establish the city minimum wage within two weeks of the publication of the new state minimum wage.

Burien: https://www.burienwa.gov/city_hall/laws_regulations/minimum_wage

Employers with 20 or fewer full-time equivalents (FTEs) are exempt from the ordinance.

“Level 1 employer” means all employers, including franchisees, that employ 500 or more FTEs in King County or franchisors who employ 500 or more FTEs in the aggregate. Effective January 1, 2025 at 12:01 a.m., Level 1 employers shall pay each employee an hourly minimum wage of at least $4.50 over the Washington State hourly minimum wage.

“Level 2 employer” means all employers, including franchisees, that employ 21 – 499 FTEs in King County. Effective July 1, 2025 at 12:01 a.m., Level 2 employers shall pay each employee an hourly minimum wage of at least $3.50 over the Washington State hourly minimum wage.

“Level 3 employer” means all employers with 20 or fewer FTEs. Employers with 20 or fewer FTEs are exempt from this ordinance.

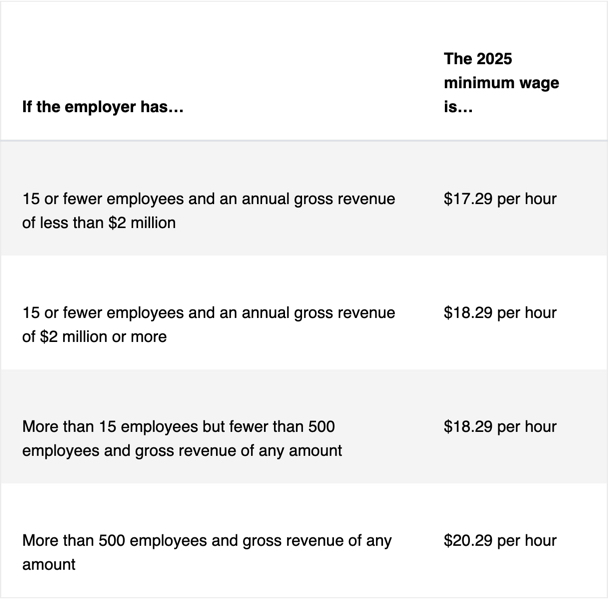

Everett: Local Minimum Wage Rates

Effective July 1, 2025. $20.24/hour for employers with more than 500 employees in Washington and $18.24 for employers with between 15 and 500 employees. Employers with 14 or fewer employees are not to be affected.

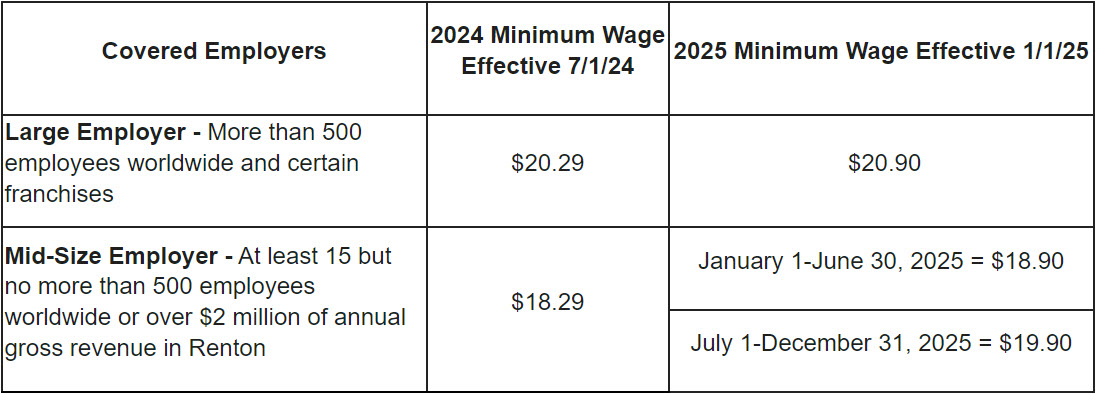

King County (unincorporated): Minimum wage in unincorporated King County – King County, Washington

On January 1, 2025, the minimum hourly wage in unincorporated King County will be $20.29. |