This is a friendly reminder that the due date to file the October 2024 Washington State Department of Revenue excise tax return is approaching.

If you have not provided the information to our office yet, please send us your October* sales (or Quarter sales for Quarterly fliers and Annual sales for Annual fliers) information by Monday morning (11/18/24) to ensure timely filing.

Corporate Transparency Act: Beneficial Ownership Information Reporting:

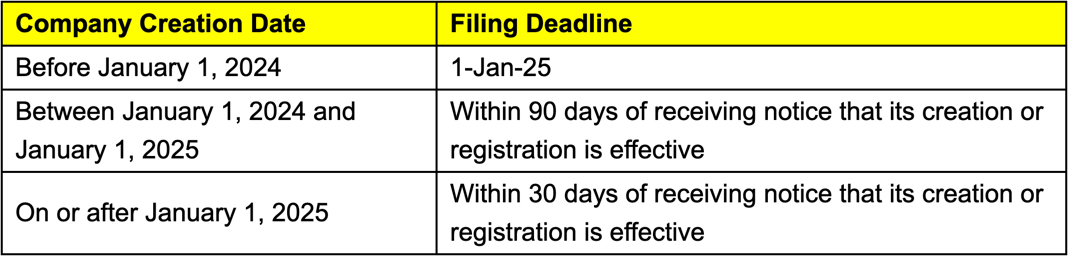

The new filing requirement, Beneficial Ownership Information Reporting (BOI) to FinCEN started in 2024. This requirement applies to all businesses that are registered with the State to engage in business. https://fincen.gov/boi.

Please keep in mind the following filing deadlines based on your company’s creation date, and make sure you comply:

Notification from Washington Department of Revenue:

Local sales tax rates in the following areas will change beginning January 1st, 2025:

- City of Burlington Transportation Benefit District

- City of Burlington Transportation Benefit District Car Dealers and Leasing Companies

- City of Covington Transportation Benefit District

- City of Covington Transportation Benefit District Lodging Businesses

- City of DuPont Transportation Benefit District

- City of Gig Harbor Public Safety Tax

- City of Gig Harbor Public Safety Tax Car Dealers and Leasing Companies

- City of Gig Harbor Transportation Benefit District

- City of Gig Harbor Transportation Benefit District Car Dealers and Leasing Companies

- Kittitas County Emergency Communication Tax

- Kittitas County Emergency Communication Tax Car Dealers and Leasing Companies

- City of La Conner Transportation Benefit District

- City of La Conner Transportation Benefit District Car Dealers and Leasing Companies

- City of Maple Valley Transportation Benefit District

- City of Maple Valley Transportation Benefit District Lodging Businesses

- City of Pullman Transportation Benefit District

- City of Snoqualmie Public Safety Tax

- City of Snoqualmie Public Safety Tax Car Dealers and Leasing Companies

A complete list of location codes and tax rates can be found here on the website.

2025 Minimum Wage Resources

Washington State: https://www.lni.wa.gov/news-events/article/24-24

The Washington State Department of Labor & Industries (L&I) announced an increase in the state’s minimum wage to $16.66 per hour, effective on January 1, 2025.

Starting January 1, 2025, all employers, regardless of schedule size, will be required to pay the same minimum wage of $20.76 per hour. Small employers will no longer be able to count tips and/or payments toward an employee’s medical benefit plan toward an employee’s minimum compensation requirements under Seattle’s Minimum Wage Ordinance.

Bellingham: https://cob.org/services/business/city-minimum-wage

Starting May 1, 2025, the city minimum wage will be set at $2.00 above the applicable Washington State minimum wage. Every year after, starting in 2026, the city minimum wage will be set at $2.00 above the applicable Washington State minimum wage, effective on January 1 every year. The city will establish the city minimum wage within two weeks of the publication of the new state minimum wage.

Burien: https://www.burienwa.gov/city_hall/laws_regulations/minimum_wage

Employers with 20 or fewer full-time equivalents (FTEs) are exempt from the ordinance.

“Level 1 employer” means all employers, including franchisees, that employ more than 500 FTEs in King County or franchisors who employ more than 500 FTEs in the aggregate. Effective January 1, 2025, at 12:01 a.m., Level 1 employers shall pay each employee an hourly minimum wage of at least $3.00 over the Washington State hourly minimum wage.

“Level 2 employer” means all employers, including franchisees, that employ 21 – 499 FTEs in King County. Effective July 1, 2025, at 12:01 a.m., Level 2 employers shall pay each employee an hourly minimum wage of at least $2.00 over the Washington State hourly minimum wage.

“Level 3 employer” means all employers with 20 or fewer FTEs. Employers with 20 or fewer FTEs are exempt from this ordinance.

Renton: https://www.rentonwa.gov/city_hall/finance/2024_labor_standards

Covered employers will be required to pay a new higher minimum wage for hours worked in the City. Covered employers are required to pay employees not less than the minimum hourly wage as follows:

SeaTac: https://www.seatacwa.gov/home/showpublisheddocument/38011/638634620180370000

2025 Minimum Wage: $20.17 per hour

The increase in the living wage rate (2.35%) has been calculated using the consumer price index for urban wage earners and clerical workers, (CPIW) for the twelve (12) months prior to September 1 as calculated by the United States Department of Labor. Therefore, in accordance with SeaTac Municipal Code (SMC) Section 7.45.050, the living wage rate in effect for hospitality and transportation employees within the City will increase to $20.17, effective January 1, 2025.

Effective January 1st, 2025, Tukwila Minimum Wage hourly rates will be:

(On July 1st, 2025, mid-size employers are required to increase their minimum wage rate to equal the large employer rate of $21.10) Going forward, mid-size employer minimum wage will be the same as the large employer rate.

If you have questions, be sure to reach out to us.

Sincerely,

ALISA NA CPAs & Advisors